Last February, three Republican members of Congress sent a questionnaire to the 56 private universities and colleges with endowments valued at $1 billion or more, seeking information about those endowments, investments, financial aid, and financial practices. The answers, provided by the April 1 deadline, offer insights into the individual institutions’ circumstances and policies, and for comparative purposes.

The University, for example, revealed its estimate of the endowment’s loss of purchasing power since 2008. Even though, in nominal terms, its value as of June 30, 2015, finally exceeded the prior peak before the financial crisis in 2008 ($37.6 billion vs. $36.9 billion), “In real (inflation-adjusted) dollars, the endowment remains below the fiscal 2008 value, by approximately $5 billion.” (And distributions from those endowment assets now support a larger physical plant, enhanced financial aid, and other costs.)

Other interesting tidbits include the following.

Investment-management expenses. Harvard Management Company (HMC) has always maintained that its hybrid asset-management model (investing a portion of the assets itself, less expensively, and retaining external managers to invest the rest) provided important economies. It has not detailed those economies to any significant extent, other than reporting, as in its fiscal 2014 letter, that its studies suggested savings of “approximately $2.0 billion over the last decade as compared to the cost of management for a completely external model” delivering equivalent investment returns. The response to the congressional query notes that the management cost for internally managed funds is “generally below 0.75 percent” and that for externally managed funds “generally averages 1-2 percent of assets under management.” Making a back-of-the-envelope calculation, using fiscal 2015 assets ($37.6 billion), yields, very roughly, $110 million of internal costs (at 0.75 percent) and $225 million to $450 million of external management costs (at 1 percent to 2 percent).

Peer institutions, which maintain small internal investment staffs and pay external managers fees to invest essentially all their assets, reported these internal and external expenses for fiscal 2015 (as a percentage of endowment assets) respectively:

- MIT, 0.12 percent, 1.0 percent

- Princeton, 0.09 percent, 1.3 percent

- Stanford, 0.15 percent, 1 percent to 2 percent

- Yale, 0.14 percent, 1.22 percent

Yale’s external cost ratio, which has declined significantly in recent years, is particularly notable. It invests less than one-quarter of its endowment assets in publicly traded stocks and bonds, the least expensive asset class to manage, and is heavily committed to typically higher-fee investments (such as private equity and venture capital), in which it has long reported extremely strong relative returns. Its low expense ratio may reflect favorable relationships it has developed with superior investment managers, who value Yale as a limited partner (investor); achieving those kinds of relationships is a high priority for HMC under its new senior management (see the discussion)—plans that may be disrupted given the disturbing news that its CEO is on medical leave.

Financial aid. The inquiring lawmakers have a special interest in undergraduate financial aid, and each responding institution spelled out its program in some detail (although with some differences in presentation); highlights follow.

Harvard reported that only one-quarter of the College class of 2015 took out loans; those who did graduated with median educational debt of $10,900. Since financial aid was liberalized, beginning in fiscal 2004, the proportion of students who receive Pell Grants (a common indicator of lower-income family circumstances), has risen from 10 percent to 18 percent.

Princeton said that just 17 percent of students have assumed debt—and the average debt load for graduates is down to $6,600. Its proportion of students receiving Pell Grants rose from 7.2 percent in the class of 2008 (entering in 2004) to 18 percent in the class of 2018. In Yale’s class of 2015, 17 percent of students assumed loans—and their average debt was a heftier $15,521. At Stanford, which unlike these peers is not need-blind for international applicants (who are therefore skewed to higher-income families), 22 percent of members of the class of 2015 assumed debt, with median loans of $16, 417.

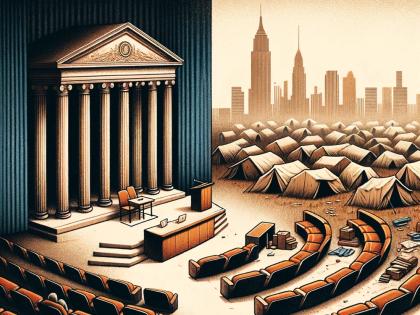

Back to the land. Finally, three institutions reported an intriguing pillar of their investments: income from owned, developed land. Princeton owns somewhat less than half of the land at the nearby Princeton Forrestal Center, developed beginning in the mid 1970s. Stanford’s “endowment land,” valued at $3.4 billion, encompasses the Stanford Research Park (with 10 million square feet of income-producing properties), the Palo Alto offices at the heart of the venture-capital industry, and more. (Another asset is the Stanford Shopping Center.) Just down the Charles River, MIT owns more than 5 million square feet of rentable commercial spaces—much of it in the red-hot Kendall Square life-sciences and technology hub. (In fiscal 2015, MIT noted, its real-estate tax payments represented more than 13 percent of Cambridge’s total tax revenues.)

Harvard’s Allston planners are surely aware of the synergies to be had from locating inventive faculty members next to entrepreneurs, innovation-minded technology businesses, and venture investors: the rationale for the planned “enterprise research campus” envisioned for Western Avenue. And its financial planners are certainly as aware of the potential to turn a vacant, brownfield landholding into a future source of long-term, stable income, at a time when other revenue sources (net tuition, sponsored-research funds, and endowment returns) appear more constrained, and volatile, than in past decades.