In one sense, the projected 30 percent decline in the value of the endowment is Harvard’s financial problem. If the invested assets earn the expected return over time, distributing funds from a $36.9-billion endowment at a typical rate (about 5 percent) yields $1.8 billion per year to support academic operations. Because the University made use of $1.4 billion in funds from the endowment during the academic year just ended, deans could reasonably expect a rising stream of revenues to pay for more faculty, increased financial aid, and new facilities—had the assets remained intact.

But an endowment now worth $24 billion or so can safely throw off just $1.2 billion annually: $200 million less than recent spending, and $600 million less than the reasonable assumption of a year ago.

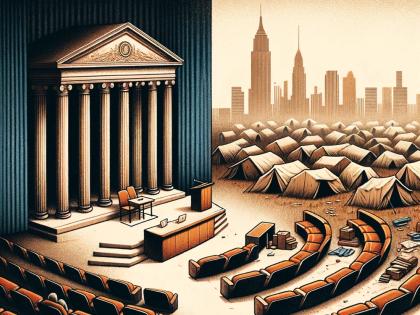

Most similar university and college endowments have reported proportional declines in value. But few other institutions (if any) undertook an Allston-sized new campus, or comparable expansions of financial aid, without benefit of a capital campaign. Thus those seeking to understand Harvard’s challenges fully need to focus on two other aspects of its financial situation today: liquidity, and leverage throughout its operations.

It may seem unfathomable that an institution holding tens of billions of dollars of investments, plus other assets, needs to worry about its funding. But the endowment has been managed for long-term total returns, and so has been diversified into asset classes that are inherently not readily convertible to cash: venture capital, private equity, hedge funds, real estate, commodities. Funding for endowment distributions has been dependent on the disbursements those investment partnerships made as they harvested successful investments (note the past tense). Moreover, the partnerships have the contractual right to summon future cash from their limited partners, like Harvard Management Company (HMC), to make new investments.

Those are not trivial claims: the University’s fiscal year 2008 financial report put the outstanding commitments at $11 billion through 2018. An April 1 credit report on Harvard’s debt by Moody’s Investors Service, the rating agency, stated the obvious concern: “that large future capital commitments…may not be funded from previously expected distributions from other private holdings.” Given the unprecedented financial conditions, HMC faces challenging decisions in balancing Harvard’s need for strong investment returns with its more sensitive liquidity position.

Moody’s also addressed Harvard’s balance sheet. The endowment losses, it said, “combined with stress in the debt and swap markets,” created “liquidity pressures.” That refers, first, to the use of short-term, variable-rate debt, which left the University exposed when the credit market could not renew loans. The second reference is to the large interest-rate swap agreements Harvard put in place in late 2004, when it arranged financing for anticipated construction in Allston. The swaps protected against rising interest rates; when they fell, the University became exposed to collateral calls and potential losses in the hundreds of millions of dollars. Among Harvard’s remedial responses, Moody’s cited the $2.5 billion in borrowings last December, undertaken to replace short-term and variable-rate debt, increase reserves (lessening untimely cash demands on the endowment), and reduce the costs and risks associated with the swaps.

Those financing measures reflect real-world pressures—hence, the concern about leverage, on several levels.

First, there is financial leverage. The University now has about $5.9 billion of debt outstanding—likely near the upper limit of borrowing if it is to retain its triple-A credit rating. In maintaining Harvard’s rating, Moody’s cited the commitment to reduce distributions from the endowment—the proximate cause of budgetary distress in the Faculty of Arts and Sciences and other schools. It also pointed to major reductions in debt-financed capital spending, perhaps extending beyond the decision to slow or even stop construction on the $1.2-billion Allston science complex. Such limitations may challenge the schools to maintain their extensive facilities, let alone fit up new scientists’ labs.

That brings to the fore the dimensions of what might be called “operating leverage”: Harvard’s recent, increased willingness to accelerate its academic ambitions even more as the endowment grew.

Capital spending is a tangible example, of course. Beyond the science complex, much—or perhaps all—of the construction envisioned for Allston depended on debt financing, absent any capital campaign to pay for dedicated facilities. The central administration assessment that offsets Allston costs—put in place at the end of Neil L. Rudenstine’s tenure and extended through 2031 under President Lawrence H. Summers—levies an annual half-percent fee on the endowment. It yielded $168.4 million in fiscal year 2008. But that revenue stream in turn could have been used to cover large borrowings (up to $10 billion in financing was bruited about) to put many of the Allston facilities in place quickly.

Meanwhile, deferred labs were built. FAS has since mid decade nearly quadrupled its debt service for capital projects, to an estimated $110 million in fiscal year 2010. And FAS’s faculty’s ranks, constant at about 600 for 40 years, grew more than 20 percent from 2000. Spending on undergraduate financial aid accelerated from $81 million in fiscal year 2005 to $136 million last year.

Across the University, an essential mechanism for effecting these rapid increases in spending was Summers’s “incremental” payouts: a process introduced in fiscal year 2006 that offered each dean an additional annual increase in a school’s endowment distribution for agreed-upon purposes—faculty growth or expanded financial aid—in some years doubling the funds made available (see “The Payout Payoff,” March-April 2005, page 61, and “Sharing the Wealth,” March-April 2006, page 70). In the spirit of the times—with exciting academic ambitions, an endowment compounding at an annual rate of 17.6 percent from 2003 to 2008, and rising pressure from Congress to spend more of the largess—why not?

There were warning signs. In January 2006, FAS disclosed a projected annual deficit of $40 million—and foresaw much higher costs through the end of the decade (see “Fraught Finances,” March-April 2006, page 61). In a briefing, its Resources Committee outlined ways to offset the swelling deficits: internal cost-cutting (which succeeded in 2006); anticipated higher endowment distributions; “decapitalization” of unrestricted endowment assets; added central administration spending on FAS (itself dependent on the value of central endowment funds); and fundraising.

One risk was identified by Olshan professor of economics John Y. Campbell, an HMC board member, who said, “Bad stuff could happen” to the endowment. If so, he foresaw Allston as the “shock absorber”—development could slow to cover FAS’s ballooning costs. His then-colleague, Caroline M. Hoxby (now at Stanford), noted that aggressive use of unrestricted funds could lead to trouble, as the capital covering the costs of unendowed faculty growth and financial aid was stretched thin. Observing that faculty hiring and buildings were not “reversible,” she said, “Even if you are very, very rich, you can spend more than you have.”

Indeed: at that time, FAS’s endowment was valued at $11.7 billion—which likely exceeds its value now. But FAS’s spending has become ever more reliant on endowment distributions, which contributed 30 percent of income in 1995, 47 percent in 2005, and 56 percent in the year just ended—a much higher proportion, it seems, than at any peer institution.

The anticipated fundraising remains deferred. Within weeks of that January 2006 faculty meeting, FAS’s dean was on his way out; a few months later, Summers himself had left office, and any hope of planning a capital campaign was gone. And in the past year, much of the wealth that might have been tapped has been vaporized.

In 1908, Charles W. Eliot was nearing the end of his ambitious, expansive 40-year Harvard presidency. In his Harris Lectures at Northwestern University, published as University Administration, he touched on finances: “For enlargements, new equipments, and the occupation of new fields of usefulness, “ he said, a university “should rely on new endowments or new annual receipts…. In endeavoring to use all its proper income, it may sometimes incur a deficit; but it should forthwith take measures to prevent the recurrence of such a deficit, since habitual deficits…must be charged either to past endowments which ought to be held unimpaired, or to future resources which are only hoped for. Each of these methods is objectionable….” Though the twenty-first-century University differs greatly from Eliot’s Harvard, his voice still resonates.

A style of financing Harvard’s academic aspirations that seemed apt in the halcyon years through 2008 now appears to have been risky in many ways. The University became accustomed to living large—even larger than its world’s-largest endowment could sustain. Of course, hindsight cannot undo past decisions. Now, paying their costs will likely impose sweeping consequences on Harvard’s teaching and research, and on its faculty, staff, and students, beyond whatever steps are necessary to repair its balance sheet.