The rising value of endowments belonging to private institutions of higher education is attracting critical political attention—a special challenge for Harvard, whose $34.9-billion endowment is much the largest. In late February, the University and dozens of other institutions responded to a U.S. Senate Finance Committee request for information on tuition and financial aid; the size, performance, and management of the endowment; and policies governing its use.

In late April, Steven T. Miller, the Internal Revenue Service commissioner of tax-exempt and government entities, told a Georgetown Law Center seminar that his colleagues would study the application of the agency’s “commensurate test”—an enforceable standard that seeks to ensure organizations “spend in line with their resources”—to colleges and universities, but would not necessarily “devise inflexible rules” about spending.

State governments have been mulling their own actions. Late in April, a Massachusetts legislator proposed a 2.5 percent tax annually on endowment assets to generate revenue for the Commonwealth.

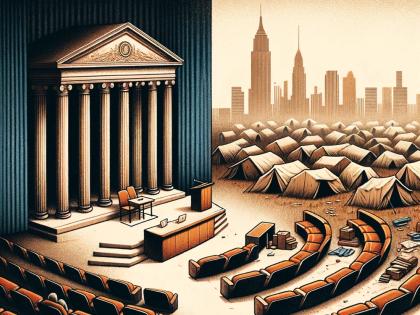

Even within higher education—where most private institutions have minimal endowments, and public schools fight for scant or diminishing resources—the frustration shows. Writing in the May/June issue of Currents, the magazine of the Council for Advancement and Support of Education (the trade organization for education fundraising professionals), Donald J. Farish, Ph.D. ’70, president of Rowan University in New Jersey, critiqued Harvard’s enhanced financial aid for students from upper-middle-income families, announced last December (see “Boosting College Financial Aid,” March-April, page 54). Focusing only on that budget item (not on graduate and professional education, research costs, etc.), and on the strong endowment investment returns in a single year, Farish wrote of the aid initiative’s $22-million annual cost, “Harvard’s endowment increased by $6 billion during the past year. A 5 percent spending mandate [see below] would require Harvard to spend $300 million of that increase.… One might ask Harvard what its plans are for the remaining $278 million.”

He proposed a 15 percent capital-gains tax on universities’ investment income, the proceeds to be “dedicated to federal need-based programs for qualified students at institutions with endowments that amount to less than, say, $10,000 per student.”

None of these proposals appears likely to advance soon, but they suggest broader public concerns, and Harvard administrators are eager to address such issues. Associate vice president for government, community, and public affairs Kevin Casey, the lead spokesman so far, noted that Senator Charles Grassley (R-Iowa) “has been focusing on…issues relating to endowments of the top universities for a while.” That interest grew from an investigation of foundations and other philanthropic organizations (tax exempt, but without operations, personnel, or budgets comparable to those of a college or university), where instances of abusive spending and slight charitable work have surfaced.

Because the finance committee is involved in oversight of financial-aid tax credits—and because, as Casey said, the tuition costs associated with higher education have been “a populist issue for some time for good reason”—Grassley and Senator Max Baucus (D-Montana) became interested in affordability and the use of endowments in that regard. (Even before the recent round of “robust” financial-aid enhancements, Casey said, Harvard, Yale, other universities, and education associations were able to convince interested senators that “the highest-endowed institutions are actually doing the most on financial aid.”)

That prompted broader queries into endowments and spending policies, associated with some Senate discussion of a mandated rate of distribution from endowments, perhaps like the 5 percent per year required of nonprofit foundations. (Harvard has apparently reached that level only once in the past decade, even when including both distributions for operating expenses and extra or unusual distributions for purposes such as financing Allston development or a recent $100-million sum for Faculty of Arts and Sciences construction expenses. For details, see Harvard’s response to the Senate committee at www.hno.harvard.edu/press/pressdoc/supplements/baucus_ grassley.pdf.) The committee members were “impressed” by the institutions’ filings, Casey said, and now appear to view the assets more broadly—not just as support for undergraduate education, but also for research, the arts, and university operations as a whole.

Of states’ interest in private endowments, Casey said, “They’re all in tough budget times.” The Massachusetts proposal would tax the nine institutions with $1 billion or more in such assets. Yet “Outside the purview of this discussion,” he noted, such institutions have always been seen as “the great asset of Massachusetts”—in research potential, employment, and associated economic impacts.

State budget problems can, of course, exacerbate pressure on public higher-education institutions—even flagship research universities, which find themselves battling to match private peers’ balance sheets as they try to finance student aid and pay faculty members. The percentage of such institutions’ funds coming from state coffers has been declining over time, Casey said. “In an era when most scientific publications arise through collaboration among people from multiple institutions, it’s in the national interest to foster strong public and private universities. State budget stresses are challenging public universities in ways we should all be concerned about.”

Harvard has a responsibility to contribute to the wider discussion about support for education, Casey added. “It is really important for these institutions to come together to make a coherent argument—not just Harvard and Yale but Wisconsin and Michigan—as to why these are national assets.” The recent public attention has made education leaders aware that they cannot “take for granted that the public understands how important these institutions can be.”

How to proceed in this conversation, he said, has become a concern at the highest level of the University. As the administration seeks a new vice president for government, community, and public affairs, such issues will no doubt loom large in the discussion.