The fact that Harvard has agreed to pay Watertown $3.8 million annually plus 3 percent compounded over 52 years (see "Watertown-Gown," November-December 2002, page 54) as part of a revenue-protection agreement has not gone unnoticed in the University's other host communities. In the public discussion following the annual town-gown report presented by Harvard to the Cambridge planning board, one resident noted that the University pays $6.3 million in taxes and payments in lieu of taxes (PILOT) on its entire Cambridge campus while Watertown receives $3.8 million (with an escalator) for the 30-acre Arsenal property. But the Watertown payments, say University administrators, reflect the tremendous impact that Harvard's acquisition of a fully improved property—representing one-third of that town's commercial tax base—could one day have on Watertown.

Because the payment was based on property taxes due on the Arsenal property during a booming economy, and the vacancy rate there recently has soared as high as 50 percent, the deal appears to be a win for Watertown. Harvard has yet to convert any of the property to tax-exempt use, yet is still responsible for making the payment as though the property were fully occupied. But chief University planner Kathy Spiegelman, director of the Allston initiative, says that during the 52-year term of the agreement, fluctuations in the real-estate market will dwindle to relative unimportance. What the University really values, and what led to a breakthrough in the year-and-a-half-long negotiation process, was Watertown's agreement to allow Harvard to use the buildings and the property for a range of academic purposes without having to seek special zoning permission each time.

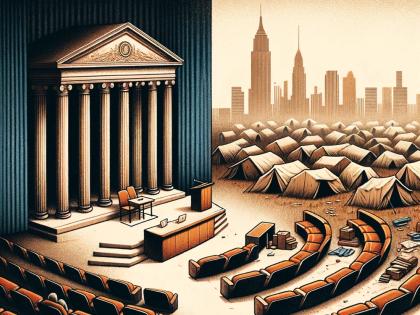

|

| The main Arsenal complex building, now home to several commercial businesses |

| Photograph courtesy of Harvard Planning |

"That is a surprisingly valuable commodity for Harvard," echoes Mary Power, the University's senior director of community relations, "particularly in the face of downzoning petitions and neighborhood objections to use of Harvard's campus in Cambridge."

But even the road to the Watertown agreement was not without its share of media hoopla and political intrigue. Watertown's initial negative reaction to news of the Harvard acquisition was understandable, says Spiegelman, given the property's history. Town leaders had worked diligently to turn the former military installation into a viable, commercially zoned, business center. They had secured millions in federal funding to clean up the site and intended to lease it to a developer—but were persuaded, in a late negotiation, to sell it to him instead. When the developer resold the property, and residents learned that a tax-exempt institution was the buyer, it seemed their worst fears had been realized—all their work had been for naught. The town enlisted the help of the media and initiated state legislation that would have limited nonprofits' tax exemption under certain circumstances.

In the State House, Harvard was a sitting duck. "Within the nonprofit sector," says Kevin Casey, Harvard's senior director of state and federal relations, "Harvard is a unique institution in terms of its scope, its size, and its financial wherewithal," and that makes it difficult to explain to people why the University merits its nonprofit status for education and research. Yet, "regardless of size, we have only three major sources of income," he explains: "Tuition, room, and board, which doesn't cover the cost of the service provided; federal research funding, which does not cover the full cost of the research; and donations, which go to support education and research." None of those are profit-making centers, "but it is hard for people to conceptualize that when they think of a multibillion-dollar endowment and a place as large as this University," Casey says. "Those are perceptions that are hard to run away from."

|

| The Arsenal complex from the air. Harvard's acquisition of the property, including a long-defunct power plant (below), initially alarmed Watertown residents, who were concerned that eventual removal of the fully developed commercial property from their tax rolls would irreparably harm their revenue base. |

|

| Photographs courtesy of Harvard Planning |

Harvard "never felt that the Watertown purchase would be a detriment to the community," says Casey. "We always thought that we would come to an equitable agreement because we have always had PILOT agreements with our host communities. We were the first university in the country to have a PILOT agreement, going back to the 1920s."

"If the University is going to expand its real-estate holdings," says Spiegelman, "then we have to take into consideration what the impact of that expansion is. Unlike the case in Allston, where we have a whole series of investments that we are going to make in infrastructure and other community benefits, in Watertown our one single acquisition was a literal revenue source for a small town. The land was on the tax rolls, so it was appropriate to guarantee some form of income stream."

The Watertown agreement is unique, but Harvard's principle of keeping communities whole when property, newly acquired for academic use, is taken off the tax rolls applies in each of Harvard's host communities. Says Alan Stone, vice president for government, community, and public affairs, "Obviously we knew that when the Watertown PILOT was completed, other communities would take notice. This is a natural thing."