Investing in the stock market can seem like walking a tightrope above a financial chasm. But instead of balancing themselves against unforeseen risks, many investors fail to diversify their portfolios and wiggle onto that tightrope on just one foot.

|

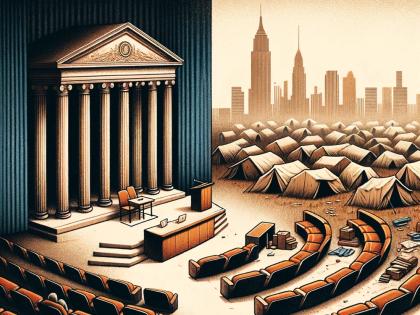

| Illustration by Christopher Bing |

"Undiversified investing has become riskier than ever," says John Y. Campbell, Eckstein professor of applied economics. In a series of papers, Campbell has examined trends in market records from 1962 to 1997 and found that even though the stock market itself hasn't become more volatile, the volatility of randomly selected stocks has risen by 40 percent and the correlations among stocksa measurement of the movements of individual stocks relative to the whole markethave also dropped. (In the early 1960s, a typical U.S. stock had a correlation of between 0.25 and 0.30 with other stocks, but by the late 1990s this correlation had fallen below 0.10.) The data suggest that because individual stocks are less connected, they now react more violently to the wobbling of their parent companies and don't spread as much of this volatility to the rest of the market. In addition, volatility across business sectors has increased in the last several years.

An investor's rule of thumb once called a 20-stock portfolio well diversified and relatively free of excess risk. Now such a portfolio carries an excess risk of 10 percentage points, twice its former level. To achieve acceptable protective balance today, Campbell explains, investors need a portfolio packed with 50 different stocks.

"Diversify Now!" seems a fitting battle cry for investors, and it can even be heard on Capitol Hill, where some lawmakers have proposed forcing investment diversification in pension accounts. But what changed?

In part, notes Campbell, the changes stem from the disappearance of corporate conglomerates. In the 1960s, conglomerates like International Telephone and Telegraph were like trendy spiders of the business world: deftly crawling across sectors and acquiring many different companies, they achieved diversity and reduced risk within one parent stock. But by the 1980s, Campbell says, those spidery conglomerates were breaking up, and less-interconnected businesses emerged from the fragmented webs. No longer reaching from gas and shipping to automobiles and food products, these companies reversed the previous trend by focusing on narrow specialties, or "core competencies."

Undiversified retirement plans further increase the risks, as illustrated by the multibillion-dollar Enron implosion that not only bludgeoned investors, but devastated employees' retirement funds. "Enron is the most lurid example of the trouble you can get into," Campbell says. To illustrate the danger, he cites the work of Shlomo Benartzi of the University of California at Los Angeles. Benartzi found that among large companies in the Standard & Poor 500-stock index that match employee contributions to 401(k) retirement plans, one-third fail to diversifyand instead match their employees' contributions with company stock. If the company goes bust, workers' savings can vanish.

Diversificationakin to putting two feet on the tightrope, hoisting a balance bar, and setting a safety net belowcan reduce risks without reducing returns. But that's not as easy as it used to be. People need to pay more attention to their money, Campbell says. Although he doesn't recommend that investors try to manage a 50-stock portfolio, he offers some basic guidelines, like buying well-balanced mutual funds rather than individual stocks. Investors, he adds, "should have some international stocks, some index securities, and should look beyond the S & P 500." They should also avoid overconfidence in their company stock and invest 401(k) money outside their industry. "Many more people think they have inside information than actually do," Campbell explains. "Before Enron, people might have said, 'Well, other people's companies might get into trouble, but not mine.' That overconfidence can prevent you from doing prudent things to protect yourself."

~Neil Shea

John Campbell website:

http://post.economics.harvard.edu/faculty/campbell/campbell.html